Tax scams start in January with fake IRS messages targeting Americans

2026-02-18 15:02:17

newYou can now listen to Fox News articles!

Tax season It no longer starts in April. For scammers, it starts the moment the calendar flips to January.

While you’re waiting for your W-2 or 1099 number to arrive, cybercriminals are already sending waves of fake IRS letters, “refund issue” alerts, and account verification scams. These messages ring alarmingly real, and that’s no coincidence.

The truth is that today’s tax frauds do not rely on random guessing. They rely on your personal data, which has been pulled from online data brokers, Public records and past violations. Once your information is traded, it becomes part of a list of high-value targets.

Let’s break down what’s really going on – and how you can protect yourself before the first fake message lands in your inbox.

Sign up for my free CyberGuy report

Get the best tech tips, breaking security alerts, and exclusive deals delivered straight to your inbox. Plus, you’ll get instant access to my Ultimate Scam Survival Guide – for free when you join my site CYBERGUY.COM Newsletter.

Robinhood Text Scam Warning: Do not call this number

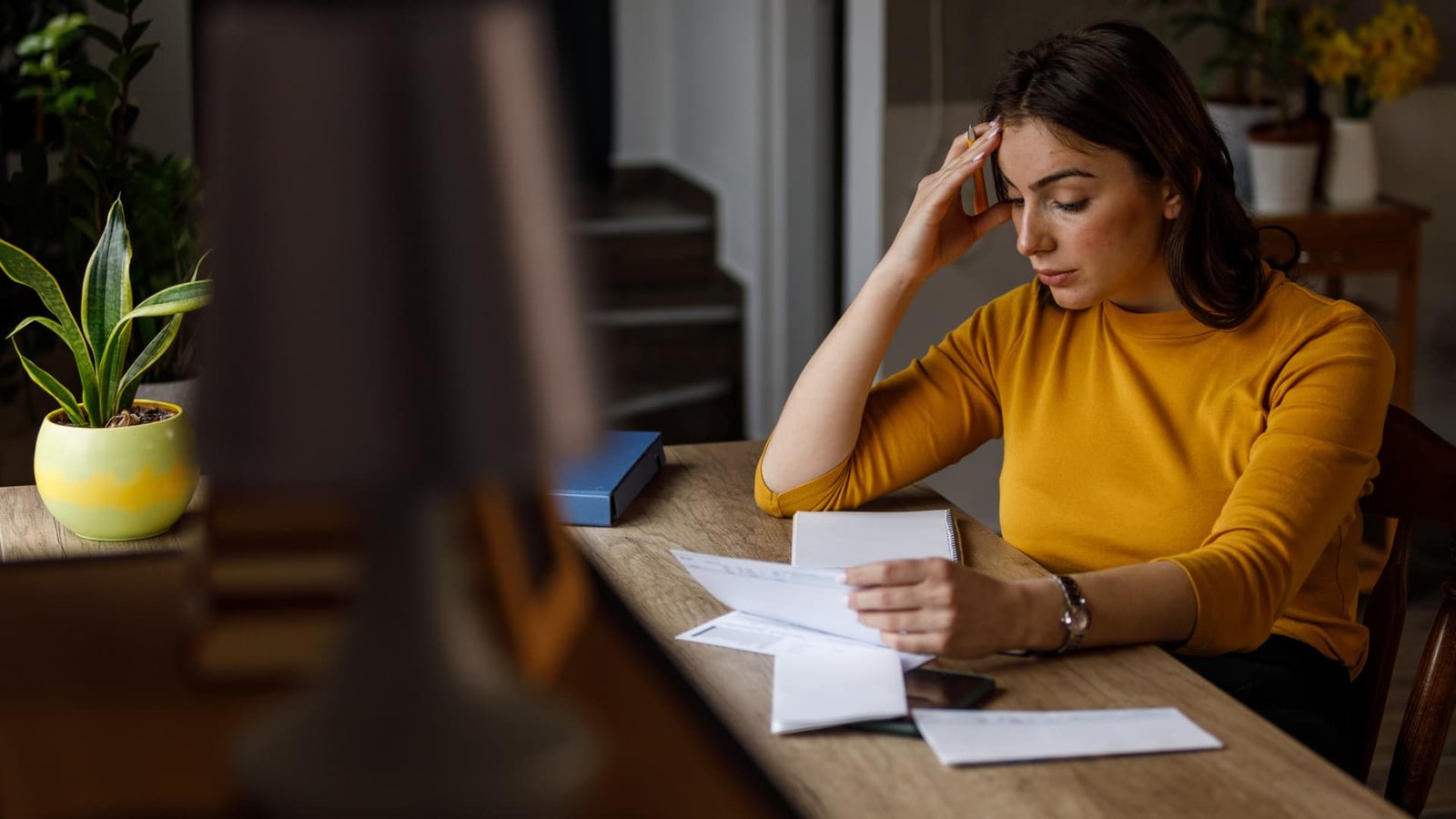

Tax scammers are targeting Americans as soon as January with fake IRS emails and refund alerts designed to steal personal data. (Photo illustration by Michael Boccheri/Getty Images)

The new wave of tax fraud

Every year, scammers improve their tactics. And every year, they get better at making their messages look legitimate. Here are the most common scams that plague Americans before tax season reaches its peak:

1) Fake IRS emails and texts

These messages It looks official. They use real IRS language, government-style formatting and even fake case numbers. You may see something like:

“Your tax account is under audit. Immediate action is required to avoid penalties.”

The email may include the following:

- Official-looking IRS logos and titles

- Threatening language about audits or fines

- A link that appears to go to a government website.

But when you click, you’re taken to a fake IRS portal designed to steal:

- Your social security number

- Your date of birth

- Your bank account details

- Your IRS login credentials.

Once scammers have this, they can file fake returns, redirect your refund, or impersonate you for years.

2) “Refund Issue” alerts.

This is one of the most effective tax scams because it preys on something people are actually waiting for: their money. The message usually says:

“Your tax refund was delayed due to a verification issue. Please confirm your information.”

It feels believable. I just submitted. You expect a refund. The message will arrive immediately when you verify your bank account.

The link leads to an idealized version of:

- Government website

- Tax return submission service

- Or the bank login page.

Every keystroke What you enter is captured. Fraudsters now have your identity, finances and tax information, all with one click.

3) Benefit and identity verification scams

These scams impersonate:

- IRS

- Social Security Administration

- Government tax offices.

Often times, they use what appear to be legitimate titles like “tax resolution administrator” and state that you have unresolved tax activity. They claim that your benefits, tax records, or identity are “suspended” and should be verified immediately.

Typical messages say: “Your benefits account has been temporarily suspended. Verify your identity to restore access.” Or: “We’ve detected unusual activity in your tax file. Confirm your information now.”

The goal is simple: panic. When people panic, they don’t slow down. They don’t check back. They click. Once they do this, the scammers collect everything they need to completely impersonate the victim.

How to safely view your bank and retirement accounts online

Cybercriminals use data broker profiles and log breaches to personalize tax fraud and make them appear legitimate. (Photo: Andrew Harrer/Bloomberg via Getty Images)

Why do these messages seem so real?

You may be wondering: How do they know my name? My address? My tax service?

They don’t guess. They buy it. Data brokers collect and sell profiles that can include the following:

- Full name and date of address

- Phone numbers and email addresses

- Family members and marital status

- Estimated income and property records

- Age, retirement status, and employer history.

Scammers use this data to personalize their messages. That’s why e-mail It doesn’t seem random. It feels mean to you. Once your profile is sold or leaked, it can be reused over and over again.

The real goal is not to get your money back. It’s your identity

Once scammers steal your Social Security number, tax ID, or banking details, the damage doesn’t stop at one scam.

They can:

- Submitting fake tax returns

- Opening lines of credit in your name

- Redirecting benefits

- Selling your identity in criminal markets.

Tax fraud is often the entry point for long-term identity theft.

“Pre-tax season cleaning” is something most people skip over

Most people think that clearing browser cookies or changing passwords is enough. it’s not. Your information still resides in data broker databases, where scammers shop around for victims.

That’s why I recommend Data removal service Which automates data removal and goes straight to the source. Instead of going after scams one by one, these services help remove the reason you were targeted in the first place.

While no service can guarantee complete removal of your data from the Internet, a data removal service is truly a smart choice. It’s not cheap, and neither is your privacy. These services do all the work for you by systematically monitoring and scraping your personal information from hundreds of websites. This gives me peace of mind and has proven to be the most effective way to clear your personal data from the Internet. By limiting the information available, you reduce the risk of fraudsters cross-referencing data from breaches to information they might find on the dark web, making it harder for them to target you.

Check out my top picks for data removal services and get a free check to see if your personal information really exists on the web by visiting Cyberguy.com.

Get a free check to see if your personal information is already on the web: Cyberguy.com.

Practical steps to protect yourself this tax season

Here’s what I recommend before applying:

- Never click on tax links From emails or texts. Go directly to the official websites. strong Antivirus software It can help block malicious links before malware is installed or personal information is stolen. Get my picks for the best antivirus protection winners of 2026 for Windows, Mac, Android, and iOS at Cyberguy.com.

- Use strong and unique passwords For tax services and email. A password manager helps you create and store strong, unique passwords, and alerts you if your email has been exposed to known data breaches. Next, check if your email has been exposed in previous breaches. Our #1 password manager pick has a built-in penetration scanner that checks if your email address or passwords have appeared in known leaks. If you discover a match, immediately change any reused passwords and secure those accounts with new, unique credentials. Check out the best expert-reviewed password managers of 2026 at Cyberguy.com.

- Enable two-factor authentication (2FA) wherever possible.

- Freeze your credit If you are not applying for loans. To learn more about how to do this, go to Cyberguy.com And search “How to freeze your credit.”

- Remove your data from brokers Before scammers find it, as discussed above.

Valentine’s Day 2026 Romance Scams and How to Avoid Them

Fake “refund issue” messages trick taxpayers into entering Social Security numbers and banking details on fraudulent sites. (Photo illustration by Michael Boccheri/Getty Images)

Key takeaways for Kurt

Tax scams don’t start in April; It starts when you sell your data. The more complete your profile becomes, the easier it is for scammers to impersonate government agencies and steal your identity. By removing your personal data now, you’re not only protecting your refund; You are protecting your future. This tax season, don’t wait for an alert. Remove the risk.

Have you received a suspicious text or email from the IRS this tax season, and what made you wonder if it was real? Let us know by writing to us at Cyberguy.com.

Click here to download the FOX NEWS app

Sign up for my free CyberGuy report

Get the best tech tips, breaking security alerts, and exclusive deals delivered straight to your inbox. Plus, you’ll get instant access to my Ultimate Scam Survival Guide – FREE when you join my site CYBERGUY.COM Newsletter.

Copyright 2026 CyberGuy.com. All rights reserved.

https://static.foxnews.com/foxnews.com/content/uploads/2026/02/woman-files-taxes-with-irs.jpg

إرسال التعليق