How activist Elliott may use its data center know-how to lift returns at Equinix

2025-08-02 11:09:31

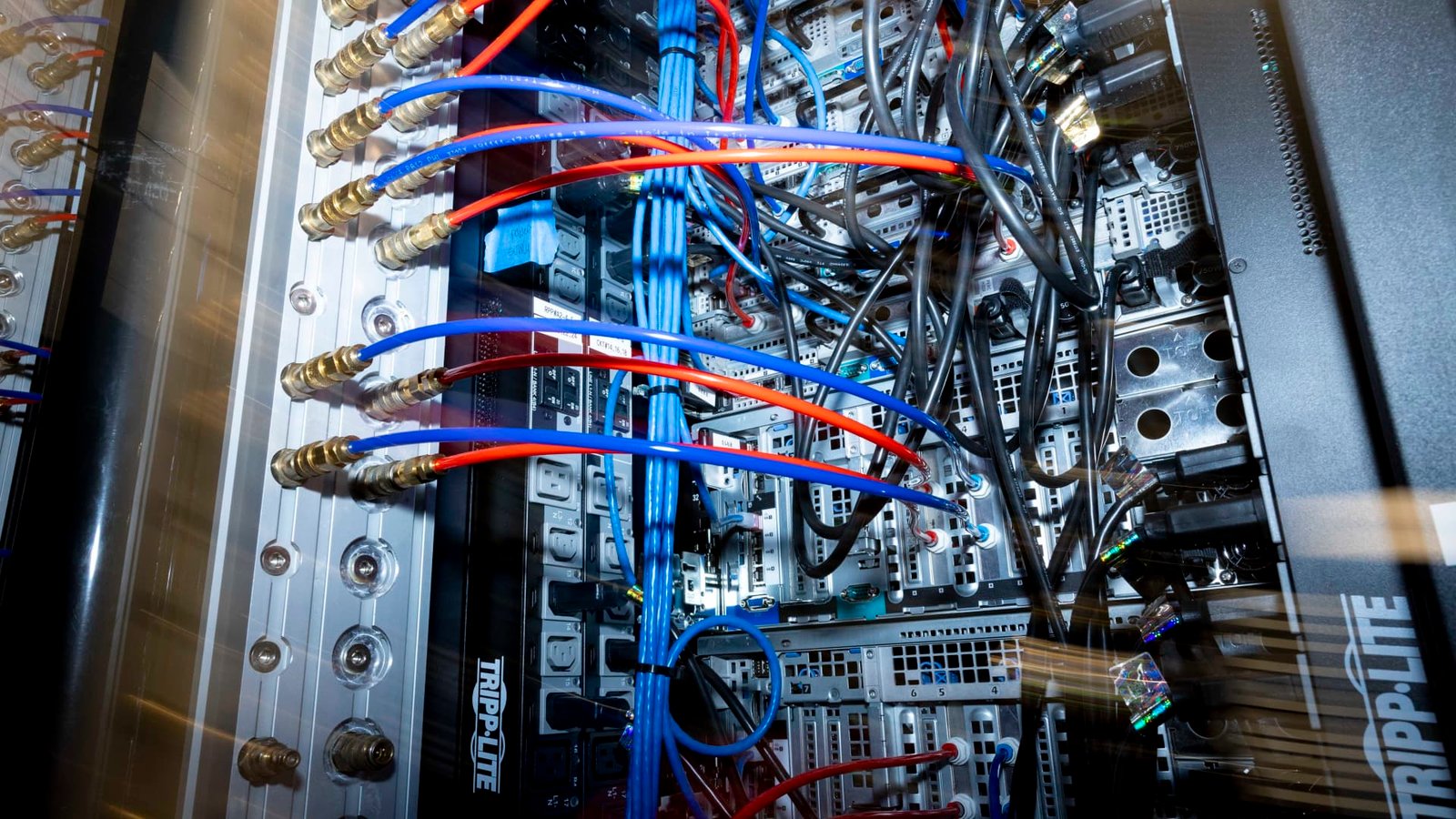

Inside one of the Equinix internal operations at the Equinix Data Center in Ashburn, Virginia, on May 9, 2024.

Amanda Andradi Rohodes Washington Post Gety pictures

Company: Equinix Inc (eqix)

a job: equinix It is a real estate investment fund and an operator of 270 data centers in 75 metro regions worldwide, as it provides assembly and interconnection services that convey networks, cloud services providers, institutions and hyperactivity. The company platform combines the global fingerprint of the International Business Stock Exchange (IBX) and Xscale data centers that support the customer’s need to implement, operate and maintain tied publishing operations. Equinix data centers are found primarily in the main Users markets in the American regions, Asia Pacific, Europe, the Middle East and Africa (EMEA).

Market value shares: 75.53 billion dollars ($ 771.75 per share)

Equinix shares in 2025

Activist: Investment Department Elliot

ownership: us

Average cost: us

Activist’s comment: Elliot is a very successful active investor. The company’s team includes analysts from private technical stock companies, engineers and operating partners – former technology executives and Coos. Upon evaluation of investment, the company also rented specialization and public administration consultants, experts and industry experts. Elliot often sees companies for many years before investing and have a wide -ranging stable from admiration. Elliot historically focused on strategic activity in the technology sector and was very successful in this strategy. However, over the past few years, the activity group has grown. The company is more active towards governance and creates a value of the plate in a much larger range for companies.

What is happening

Elliot took a position in dependence.

backstage

Equinix is a Reit and a 270 database operator in 75 metro regions all over the world, providing assembly and interconnection services that transport networks, cloud services providers, institutions and hyperactivity. Companies are increasingly dependent on data, and the most efficient solution used cloud services like Equinix. High costs associated with building and maintaining internal data centers along with volatile data needs, owned by Equinix, allows to flourish. Collection data centers allow users to rent a space for their devices, instead of using their own space for this purpose. Within this market, Equinix varied through the global interconnected data centers located near the upper final user markets, making their offers are sticky for data providers. Nevertheless, between June 24 and June 26, the Equinix share price decreased by 17.75 %. This decrease was in response to the company’s day’s day, as Equinix revealed higher capital expenses than expected from $ 3.3 billion compared to 2025 and 4 billion dollars to $ 5 billion annually from 2026 to 2029 in addition to expectations that were reduced funds from operations (AFFO) to 5 % to 9 %. Previously, it was a range from 7 % to 10 %.

This increase in CAPEX and a decrease in non -experienced AFFO and the short -term investors, but this was an opportunity for long -term experienced investors such as Elliott Investment Management, which announced that it increased its location in horses because it originally revealed a position of 0.15 % in the company at the last 13 Fehranheit. It is important to note that Elliot has enormous experience in data centers. Everyone knows that Elliott as one of the most abundant active investors today, but what distinguishes the company here is its experience as an investor, director and owner/data center business operator. Ran Elliot Activist campaign to replace the data center operator In 2021, when the investor settled for the seat of the Board of Directors of the Director of Elliot Capricorn Jason Jennirich. The company finally got out of the switch through a sale of 48.33 % for -14.97 % of Russell 2000 during the same period. But more importantly, the Eliott experience and its perspective as an owner and operator of the UK -based ARK data centers since 2012. This gives not only a unique experience, but more than a common perspective with the administration that can welcome more than a friendly relationship here.

Therefore, when the market saw Capex as a depletion of cash flow that would not pay fruits for two to three years while data centers are built and rental, investors such as ELLIOTT saw a response to increased demand. Equinix has had standard reservations from the back winds of artificial intelligence and the growth of excessive flow over the past few quarters. With the cost of capital by 5 %, CAPEX which will lead to a return from 20 % to 30 % is great for the company’s long -term prospects. Accordingly, AFFO is expected to drop to 5 % in the next year, frightening investors in the short and less known term. But with the publication of Capex, it will rise to 8 % over the next three years and eventually return to 9 %. This will happen without any help from Elliot. But there are methods that Elliott can use its knowledge of industry and experience as an active and operator to accelerate and amplify these returns. First, Equinix can better connect its plans to the market. Given the reaction to the company’s day’s day, Equinix can clearly benefit from improved market improvements about the CAPEX plan, artificial intelligence strategy and long -term growth expectations. Specifically, although Equinix does not host the training of the artificial intelligence model, it has a unique opportunity to play a central role in the inference of artificial intelligence – or the spread of artificial intelligence models for the final users. With the maturity of artificial intelligence, the demand for reasoning will increase, and Equinix will be in a good position to take advantage of the largest provider of the world’s third -party data center with data centers deeply in the main ultimate user markets. There are also opportunities for the company to improve the cost structure and low interest expenses. The administration has already taken certain steps in this direction and aims to grow margin of 300 basis points from 49 % to 52 % by 2029 – the highest goal has ever set. However, this is still a conservative estimate that can be said, because many of his peers, including his closest counterpart, have a conservative (DRL), has higher margins. In addition, a little financial engineering can reduce the company’s paid interest rate and improve the AFFO growth per share.

Historically, multi -install Equinix has led, and her share has almost moved with DRL. However, since the day of the analysts, Equinix revenues have been weakened in DRL by about 11 degrees Celsius, and the company is now trading in 24 times slightly reduced The value of the institution/Ebitda Compared to 29-Times DRL. The company is on the right path, but it can be used a little help from an experienced investor like Elliott in implementing its plan and connecting it to the market. Elliott can do this as an active shareholder or with a panel seat. Because of the company’s industry experience and a similar perspective of the administration, we will not be surprised by its supported vision to the Board of Directors before the next annual meeting in May 2026.

Ken Squire is the founder and head of 13D Monitor, an institutional research service on shareholders ’activity, founder and manager of the 13D activist Fund portfolio, a joint fund that invests in a set of 13D active investments.

https://image.cnbcfm.com/api/v1/image/108039426-1727328143599-gettyimages-2171751221-pdjg3krrmw6r7nqtn2iw3f3cyu.jpeg?v=1754074690&w=1920&h=1080

إرسال التعليق