Berkshire CEO Abel praises Kraft Heinz for turnaround on planned split

2026-02-14 13:39:59

(This is Warren Buffett Watch’s newsletter, news and analysis on all things Warren Buffett and Berkshire Hathaway. You can subscribe here To receive it every Friday evening in your inbox.)

Berkshire Hathaway’s new CEO admires the surprising change in course announced this week by Berkshire Hathaway’s new CEO Kraft Heinz.

In a food company Fourth quarter earnings announcementSteve Cahillan said at the time since Join the company Five weeks ago, he “saw that the opportunity was greater than expected and that many of the challenges we face were solvable and within our control.”

As a result, he decided to “pause work” on Kraft’s planned separation from Heinz Which was announced last September. It would have basically reversed The merger Warren Buffett helped orchestrate in 2015.

Berkshire is the largest shareholder in Kingdom Holding Company with The 27.5% stake is currently worth $8.1 billion.

In a Statement made to CNBC And elsewhere in the media, Berkshire CEO Greg Appel supported the change. “We support the decision of CEO Steve Cahillan and the decision of the Kraft Heinz Board of Directors, under Steve’s new leadership, to pause work on the previously planned separation of the company. As a result, management can commit to strengthening Kraft Heinz’s ability to compete and serve customers.”

Figures at Berkshire Hathaway’s Kraft Heinz booth pose with a reporter at a shareholder shopping day as part of Berkshire Hathaway’s annual meeting over the weekend in Omaha, Nebraska, May 5, 2017.

Rick Wilking | Reuters

Buffett, who is not usually critical of Berkshire Holdings management, was uncharacteristically vocal about his disapproval when… Split plans were announced More than five months ago.

In an off-camera phone call with CNBC’s Becky QuickHe said he was “disappointed” and did not rule out selling some or all of Berkshire’s stake.

“It certainly wasn’t a great idea to put it together, but I don’t think taking it apart would fix it.”

Just three weeks ago, Abel seems to indicate a sharp decline From Berkshire KHC’s position with SEC registrationn for the “potential resale” of “up to” 99.9% of the 325.6 million shares it announced it owned as of September 30.

Kraft Heinz’s decision to remain unchanged maybe Help prevent these potential sales from becoming a reality.

Did Berkshire’s willingness to sell Kingdom Holding shares play a role in Cahillan’s decline?

I certainly don’t know, but if that happened, and if it was a deliberate effort to pressure KHC, it would be a significant departure from Buffett’s longstanding laissez-faire policy when it comes to companies in Berkshire’s stock portfolio.

Kraft Heinz shares fell when the split reversal was announced Wednesday morning, but quickly rebounded to end the week with a small gain of 0.7%.

Upcoming attractions

Berkshire Hathaway is expected to file the latest snapshot of its investment portfolio with the Securities and Exchange Commission after the closing bell on Tuesday.

It will reveal the shares it owns through December 31, the end of the fourth quarter.

Among Key questions:

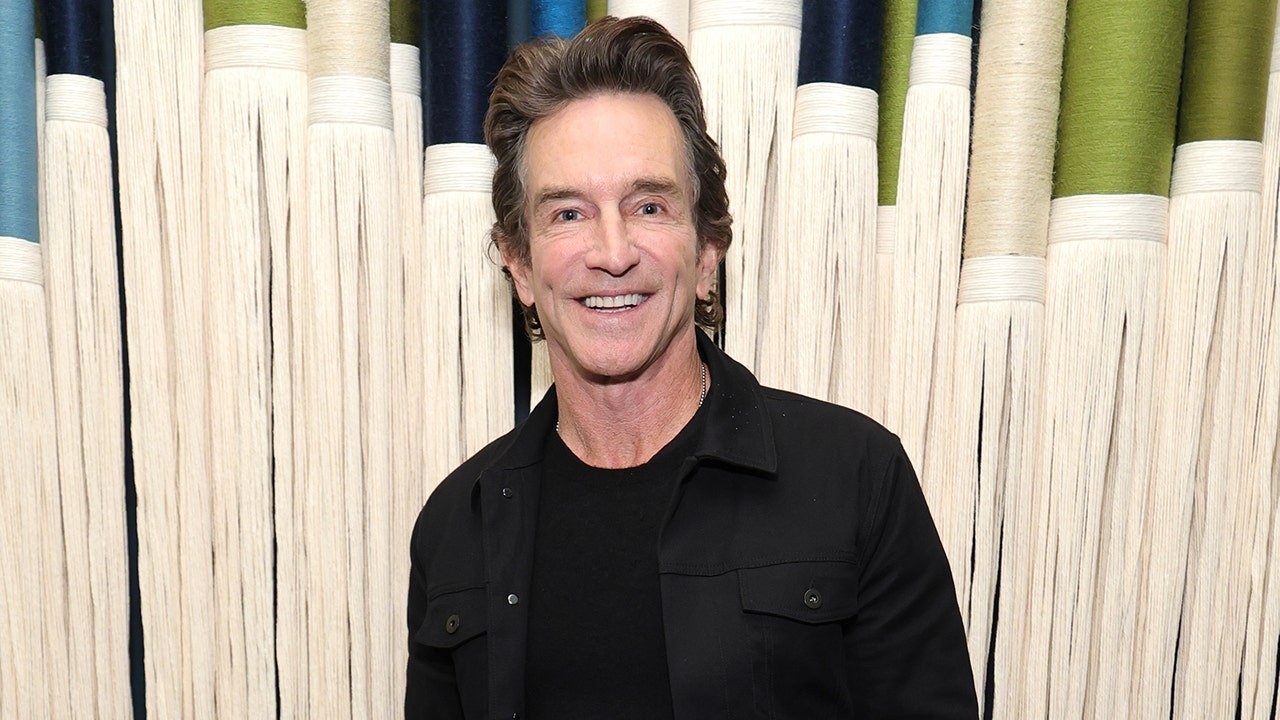

Greg Appel speaks during Berkshire Hathaway’s annual shareholders meeting in Omaha, Nebraska on May 4, 2024.

CNBC

Looking ahead, Greg Appel’s first annual letter to shareholders will be issued on the morning of Saturday, February 28 at approximately 8 a.m. ET (7 a.m. Central), according to Berkshire press release.

The company’s annual report and fourth-quarter earnings release will be released at the same time, along with information about Berkshire’s shareholder meeting on May 2.

Buffett & Berkshire about the Internet

Some links may require a subscription:

Highlights from the CNBC Buffet archives

Buffett and Munger (1994) book recommendations

Audience question: What are the three best books you read last year outside the field of investing? Why not – even one will do.

Warren Buffett: I’ll give you – I’ll first promote a book that I’ve read but that’s not available yet. But it will be in September.

I think the woman who wrote it is in the audience and she is Biography of Ben Grahamwhich will be available in September by Janet Lowe. I’ve read it and I think those of you who are interested in investments will definitely enjoy it. She did a good job of catching Ben.

One of the books that I enjoyed a lot was also written by a contributor who’s not here because he’s being sworn in, I think today or tomorrow, maybe tomorrow, as president of the Voice of America.

This is Jeff Cowan’s book, which is about…The People v. Clarence Darrow“It’s the story of Clarence Darrow’s trial for bribery before a Los Angeles jury circa 1912, when the McNamara brothers bombed Los Angeles. Los Angeles Times.

It’s a wonderful book. Jeff revealed a lot of information that was not present in Darrow’s previous biographies. I think you’ll enjoy it…

Charlie Munger: Well, I really enjoyed Connie Brock’s autobiography Game masterwhich was a biopic of Steve Ross, who headed Warner and later became co-chairman of Time Warner.

Warren Buffett: Yes, he’s a little more than just a co-chair. (He laughs)

Charlie Munger: Yes, and – she’s a very insightful writer and it’s a very interesting story.

I’m rereading a book I really love, Van Doren Biography of Benjamin Franklinwhich was issued in 1952 [1938]I almost forgot how good the book was. This is available in paperback everywhere. We never had anyone like Franklin in this country. Never again.

Berkshire stock monitoring

BRK.A stock price: $751,425.00

BRK.B stock price: $497.55

BRK.BP/E (TTM): 15.91

Berkshire Market Cap: $1,076,049,449,409

Berkshire’s cash as of September 30: $381.7 billion (up 10.9% from June 30)

Excluding railroad funds and subtracting Treasury bills payable: $354.3 billion (up 4.3% from June 30)

Berkshire shares have not been repurchased since May 2024.

(All figures are as of date of publication, unless otherwise noted)

Berkshire’s Top Holdings – February 13, 2026

Berkshire’s top holdings of publicly traded stocks in the U.S. and Japan, by market capitalization, based on the latest closing prices.

Property as of September 30, 2025, as stated in Berkshire Hathaway Files 13F On November 14, 2025, except for:

The complete list of properties and current market values is available at CNBC.com Berkshire Hathaway Portfolio Tracker.

Questions or comments

Please send any questions or comments about the newsletter to me at alex.crippen@nbcuni.com. (Sorry, but we don’t send any questions or comments to Buffett himself.)

If you are not already subscribed to this newsletter, you can subscribe here.

It is also highly recommended to read Buffett’s annual letters to shareholders. There it is collected Here on the Berkshire website.

— Alex Crippen, Editor, Warren Buffett Watch

https://image.cnbcfm.com/api/v1/image/105804601-1553099735785rtx6p2dd.jpg?v=1676724215&w=1920&h=1080

إرسال التعليق