How tariffs are shifting global supply chains

2025-07-06 23:08:24

Business correspondent

Learning resources

Learning resourcesA temporary for 90 days stopped the comprehensive definition plan Donald Trump is about to end on Wednesday, which may increase trade relations with the rest of the world. But uncertainty in the past few months has already forced many companies to rethink their supply lines in radical ways.

When an Illinois playmaker heard that Trump was providing a tariff for Chinese imports, he was so angry that he decided to prosecute the US government.

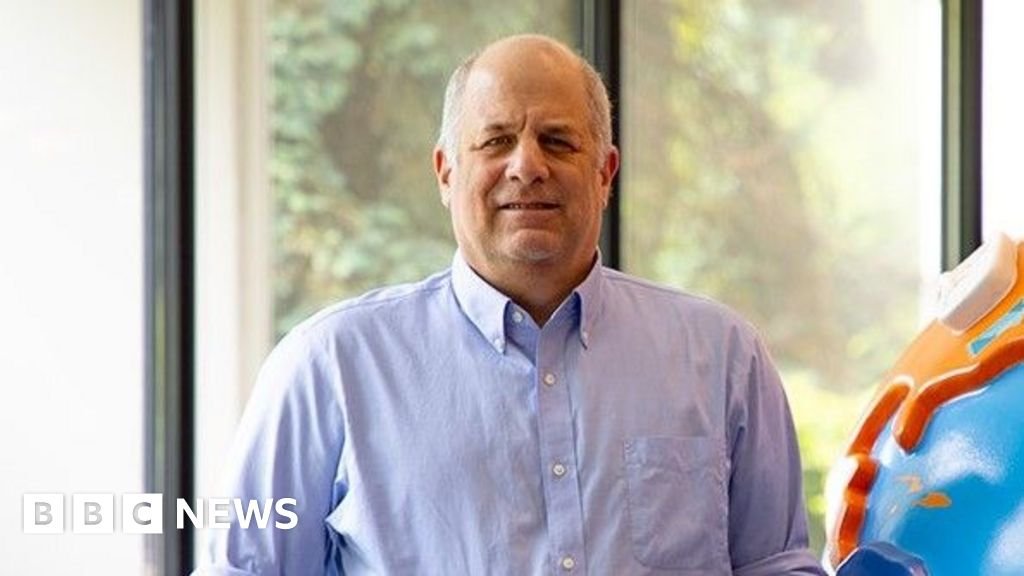

“I tend to stand when my company is in real danger,” says Rick Woldenberg, CEO of educational learning resources for learning.

The majority of his company’s products are made in China, and therefore the definitions, which importers have to pay, not Chinese exporters, now cost him a fortune.

He says that the import tax bill has jumped from about $ 2.5 million (1.5 million pounds) annually to more than $ 100 million in April when Trump increased the customs tariff for Chinese imports to 145 %. He would have “destroyed” the company, he says.

“This type of influence on my work is a little difficult on a mental winding,” he says.

With the US tariff for Chinese imports now by 30 %, this still cannot bear to many American companies such as learning resources.

So, in addition to its ongoing legal battle, it changes the global supply chain, as it moved production from China to Vietnam and India.

These two countries, like most others around the world, have witnessed that the United States hit them with 10 % general definitions, two thirds of less than those in China. Although these definitions are 10 % of scheduled to run out on Wednesday, July 9, it is still not certain what can be replaced.

Meanwhile, many Canadian companies, who often trade in both their home country and the United States, are a double success for their supply chains.

These visits are the 25 % definitions that Trump put in many Canadian imports, and the mutual treatment of the same level as Canada on a group of American exports.

Other companies around the world are looking at a lower export to the United States, because their American import partners must set prices to cover the definitions that they must now pay, making their products more expensive on American shelves.

In learning resources, Mr. Woldenberg now moved about 16 % of manufacturing to Vietnam and India. “We have gone through the process of examining the new factories, training them for what we need, and ensuring that things can flow easily and develop relationships.”

However, he admits that there are doubts: “We do not know whether they can deal with our business ability. Less than the whole world moves there at the same time.”

It also indicates that the transfer of production to another country assigned to the organization.

Meanwhile, its legal case against the American tariff, which is called “Trufffect Resources et al v Donald Trump et al”, continues on its way through the American court system.

In May, a US local court in Washington, DC, spent the definitions against him It was illegal. But the United States government has resumed immediately, and learning resources still have to pay customs duties at the present time.

Therefore, the company continues to transfer production away from China.

Learning resources

Learning resourcesThe global supply chain expert, Les Brand, says that it is charged and it is difficult for companies to transfer manufacture to various countries.

“An attempt to find new sources of critical components of everything you do – this is a lot of research,” says Mr. Brand, the CEO of the Supply Support Series.

“There are a lot of quality tests to do this correctly. You have to spend time, and this really takes away from the focus of business.”

“Transfer knowledge to train a completely new set of people on how to make your product take a lot of time and money. These are the effects of really kind margins companies.”

For the Canadian fried chicken chain, the supply chain was greatly affected by the definitions of revenge in Canada on US imports. This is because although the chicken is Canadian, it imports both specialized food refrigerators and pressure fries from the United States.

Although he could not live without refrigerators, he decided to stop buying any of the frowning. However, with no Canadian company making alternative companies, it is forced to reduce its lists in its new stores.

This is because this pressure essay needs to cook bone chicken pieces. New stores will not be able to sell bone chicken, as they are cooked differently.

“This was a big decision for us, but we believe it is the right strategic step,” says Reda Hashem, CEO of Clauc Klax.

“It is important to note that we are planning to maintain the necessary kitchen space in new locations to re -introduce these fries in the event of a fully defined uncertainty in the future.”

It also warns that with American refrigerators now more expensive for the company to buy, it is possible that the price of its food will increase. “There is a certain amount of costs that we cannot absorb as trademarks, and we may have to transfer them to consumers. This is not something we want to do.”

Mr. Hashem adds that work continues with expansion plans in the United States, and has established local supply chains of the American chicken source. She currently has one American port, in Houston, Texas.

Clack Clox

Clack CloxIn Spain, the ORO DELSERTO olive product is currently exporting 8 % of its production to the United States. It says that the American definitions of European imports, currently 10 %, should be transferred to American shoppers. “These definitions will directly affect the final consumer [in the US]Rafael Alonso Barrow, export manager of the company, says.

The company also says it is looking at the possibility of reducing its size to the United States, if the customs tariff makes trading there is less profitable, and export more to other countries instead.

“We have other markets where we can sell the product,” says Barrow. “We sell in 33 other markets, and with them all, and our local market, we can put the losses of the United States.”

Mr. Brand says that companies all over the world have been less affected if Trump has moved more slowly with his definitions. “The speed and speed of these decisions make everything worse. President Trump should have been slower and was more useful about these definitions.”

Returning to Illinois, Mr. Woldenberg is concerned about the whereabouts of Trump in his commercial battles.

“We just have to make the best decision we can, based on the information we have, then we see what is happening,” he says.

“I don’t want to say” hope for the best “, because I don’t think hope is strategic.”

https://ichef.bbci.co.uk/news/1024/branded_news/7b5c/live/dcbb3c00-485a-11f0-bbaa-4bc03e0665b7.jpg

إرسال التعليق